Enriched

Peer-to-Peer Payment App

Enriched* is a P2P (Peer-to-Peer) payment platform serving the cashless payment needs of our users, allowing low-cost solutions for transferring money to friends and merchants to enable quick and flexible contactless payments for those who don't want to carry cash.

* Enriched is not a real app. This was a project I did as part of a General Assembly Product Management course. The goal was to find a solution for a money transfer application that only had one way to transfer money to friends. Research showed that users wanted more options than just adding their bank checking account.

Did you know...

70% of the United States population carries a credit card.

- Shift Processing - Credit Card Statistics [Updated February 2020]

https://shiftprocessing.com/credit-card/

80% of the people we interviewed for this project said that credit card rewards is a major deciding factor in which credit card they carry.

Who is are our target audience / customer

- Our existing Enriched P2P money transfer app users making payments to friends.

- People who want a cashless experience to pay for things with or without a checking account.

- People paying for things in a social settings, i.e. friends out to dinner paying the bill.

What is the problem?

Currently our service only allows users to pay friends by connecting a checking account. The feature is working fine, but users want more options for funding sources.

Problem Statement:

User’s need a way to send money to friends using a credit card because they prefer using their credit card to pay for things and to get rewards.

* Many of our competitors already have this feature.

Key assumptions for tackling the problem

- Users use multiple payment methods other than just checking accounts.

- Users don’t want to have to connect their checking account to the service.

- Users would like the freedom of using multiple funding sources to send money from.

- Users want to use credit cards and to transfer money to friends.

- Users like using credit cards because of the points / rewards / miles.

- Users would like to get credit card rewards with the convenience of using an app.

We asked questions like

How do you feel about credit card rewards?

“I love them, I love that I can either get points or miles, and I can use them for statement credits or travel or whatever I want. I like that it's like paying myself back for purchases that I've already made. And it's kinda like free money, because you've already spent it.”

How do you feel about sacrificing those rewards when paying with an app?

“I'd prefer if the app allowed me to use my credit card as my primary payment method to build on those rewards, however I don't like having to pay an additional transaction fee to do that.”

The solution and hypothesis

We believe that, by allowing customers to use credit cards, then more people will use app to pay friends while taking advantage of their credit card rewards.

Our customer characteristics or personas

Abby Banker

Some have bank accounts and some do not.

Not having a bank account won’t exclude you from signing up.

Barry Researcher

They research credit card programs to get the best rewards.

Using the app would help earn more rewards.

Carol Socialite

They use the app their friends use in social settings.

Our customers don’t waste time with other apps if friends aren’t using it.

David Prepaid

They may want to add alternative forms of payments.

Younger users with prepaid credit cards from their parents would be able to use the service.

Market Sizing

Total Addressable Market

$362B

Peer 2 Peer Money Transfer Software (Total market - banks)

2018 P2P transaction volume by provider in billions: PayPal 142B + Zelle 122B + Venmo 64B + Google Wallet 28B + SnapCash 6B= 362B

Serviceable Addressable Market

$170B

Peer 2 Peer Money Transfer apps with option to use credit cards and multiple account support

47 percent of consumers surveyed prefer the use of digital apps to make payments versus cash (45 percent). 47% of 362

Serviceable Obtainable Market

$28B

Peer 2 Peer Money Transfer App Market customers whom we can capture

This is the part of the market we believe we can capitalize on

Competitive Landscape

Objectives and Key Results Focusing on MVP

Allow using credit card funding sources to send money to friends.

↑ 10% lift in user retention by next quarter

↑ 25% increase of credit card funding source usage in app by end of year

↓ 10% decrease in user churn by end of quarter

Additional OKRs Post MVP

Launch feature to allow users to signup and use app without requiring bank account.

↑ 10% increase new sign ups by end of next quarter

↓ 25% reduction of customer support emails from new users discussing lack of funding options in the next 2 quarters

↑ 10% lift in user retention by next quarter

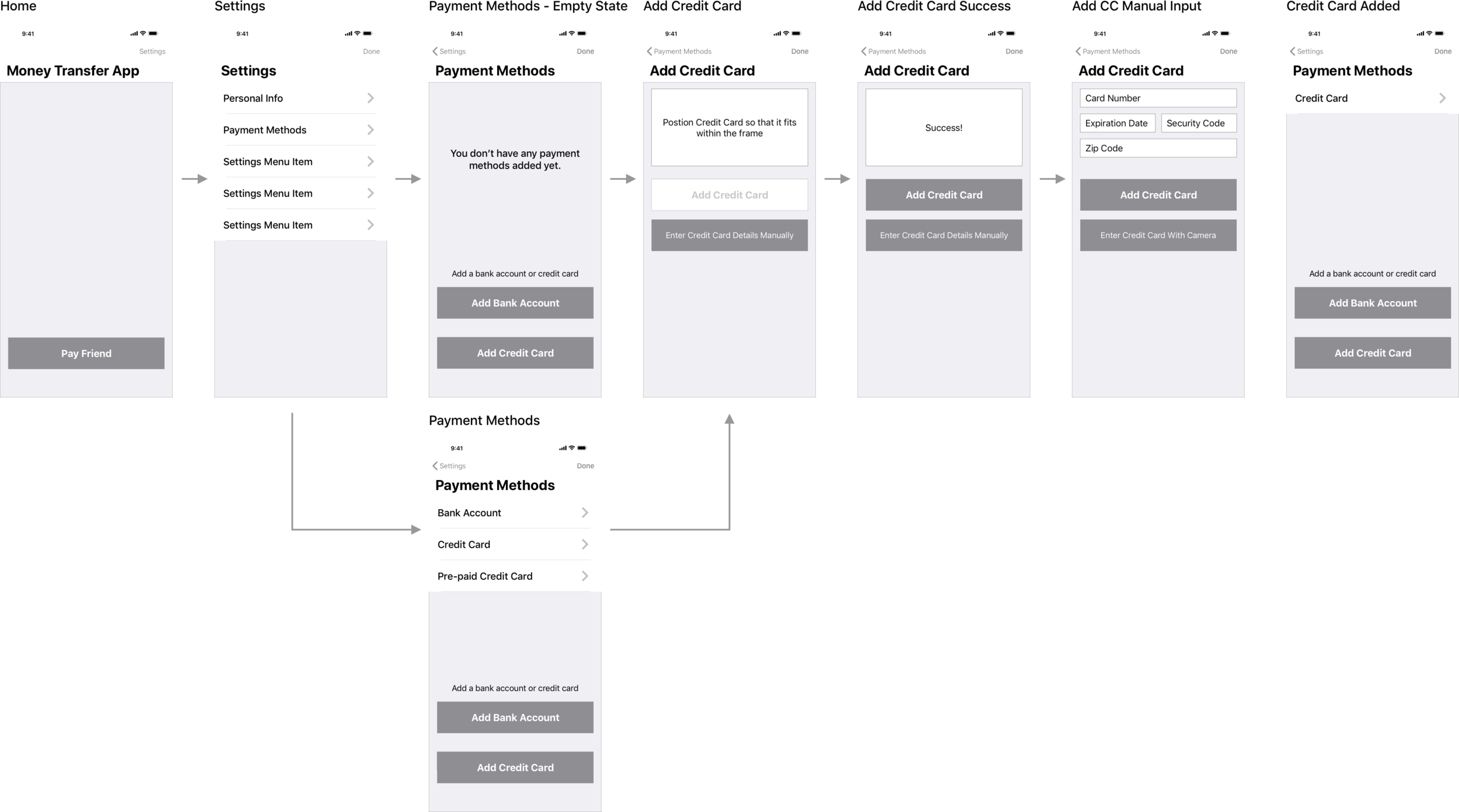

Adding a credit card flow for MVP

Feature Prioritization

Roadmap

Therefore, it’s important to tackle the high priority item "Onboarding without bank account" first, as it would become a "blocker".

Subsequent tasks would not be able to be worked on until prior task is completed.

Milestones

Alternatives considered and risks

- Prepaid credit card support - we may have different fees associated with this.

- Transferring gift cards to funding source (cash) - ‘purchasing’ user’s gift cards could be a complicated process with legal implications.

- Adding additional information inside the app, such as account balances and credit card rewards comparison tool - user’s reported that it would be helpful, but could be resource intense.

- Starting a standalone rewards program - would have to create partnerships with retailers and commercial outlet’s, may be reinventing the wheel.

User Flow

Example user stories and Acceptance Criteria

As a restaurant customer out with friends, I want to link a credit card to my P2P payment service, so that I can pay my friend.

Feature: Use credit card

Scenario: User having dinner with friends

Given I am an existing user with a credit card

When I owe others money

Then I will link my credit card to the app and pay others using my credit card.

Given I am a new user with a credit card

And I don’t have a CC linked

When I am in settings and add a new credit card

Then I should be brought to the add credit card flow

As a user of the service without a bank account, I want to sign up for the service without needing a bank account, so that I can use the service with my credit card.

Feature: Use credit card

Scenario: Onboarding and changing settings

Given I am signing up and onboarding

When I don’t have a bank account

Then I am able to sign up for service without the need for a bank account or a credit card and add an account or card at a later date.